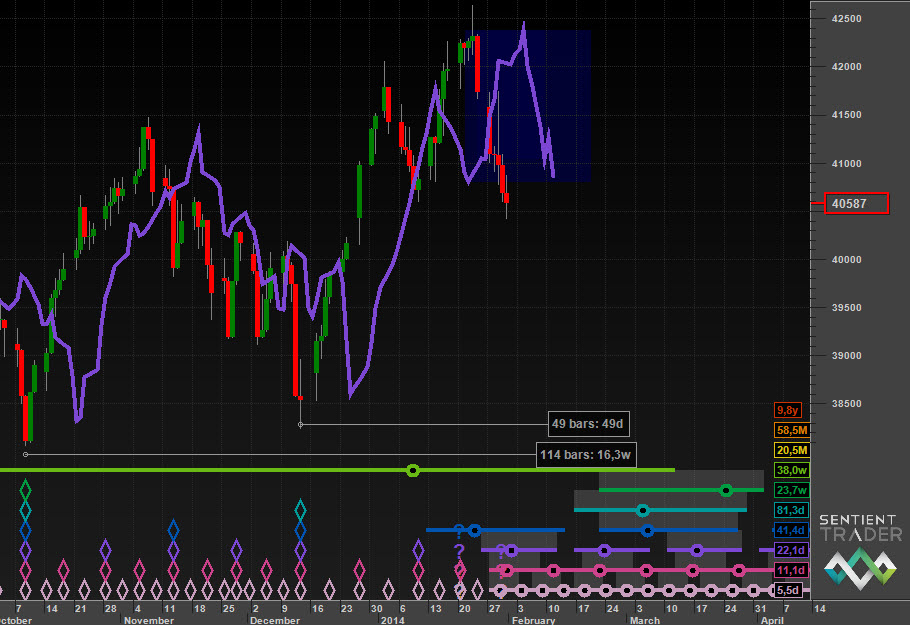

The markets have been behaving very well in cyclic terms, finding support this week at the 20-day FLD as expected. We are now expecting price to drop down through that FLD to form a 40-day cycle trough next week, as can be seen in this chart of the S&P 500 […]

Monthly Archives: February 2014

There are times in the markets that are more interesting than others, moments when the price action reveals its cyclic truth. This is one of those times. To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to […]

Evidence has been mounting recently that the cycles which move the stock markets of the world have been “running short”. Two weeks ago John mentioned it in his post about the 4-Year Presidential Cycle. This week José suggested it as the reason behind this week’s strong bounce up in Hurst […]

Hurst defined two cyclic tools – the FLD (Future Line of Demarcation) and the VTL (Valid Trend Line). I write a good deal about the FLD because I have found that to be the more reliable tool when trading, but the VTL can also be very useful, particularly for clarifying […]

Should we trade the next interaction with the 20-day FLD or not? I would like to present a novel way of answering that question. To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to receive these blogs […]