You may also like

Financial markets are influenced by an infinite number of cycles, and sometimes untangling the interaction of many of those cycles provides a […]

There are times in the markets that are more interesting than others, moments when the price action reveals its cyclic truth. This […]

As any trough is approached in the markets I always like to stand by in anticipation of that trough, in case it […]

I have spent a good deal of this week wondering whether we were bouncing out of a 40-week or 18-month cycle trough, […]

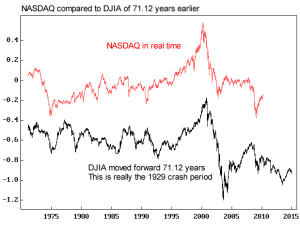

21 thoughts on “Comparison DJIA to NASDAQ 71 years later”

These are the common cycles that are at the same point after 71.12 years:

71.12, 35.56, 17.78, 8.89, 4.445, 11.85, 5.93, 2.96, 1.482, 0.741, 3.95, 1.976, 0.988, 0.494, 0.658 and 0.329 years

But note that at other points (than the big peak), other cycles will not all be at the same phase whereas at that one point these cycles all coming together dominates things.

These cycles almost exactly match Hurst’s nominal model: 17.78, 8.89, 4.445, and the 0.741 matches Hurst’s 40-week cycle, and the 1.482 matches the 18-month cycle. Interesting also to see the 5.93 cycle – I have been wondering about a 6-year “harmonic echo” for some time.

I have wondering for years why you are so stubborn about the 6 years cycle David. !

there is no no “echo” but a cycle . this cycle was discussed at lengths by Dewey and researchers of the FSC.

is it so difficult to accept a second series of cycles 4,5 months, 9 months, 18 months, 3 years , 6 years etc ?

Commentary of James E.Vaux – Executive Director of the FSC – in june 1971 on Hurst and Profit Magic –

Commentary of Gertrud Shirk – head of the Research Department of the FSC – in march 1971 on Profit Magic

Commentary of James E.Vaux – Executive Director of the FSC – in june 1971 on Hurst and Profit Magic – – part II

Hi Alain.

Those are excellent articles which I thoroughly enjoyed reading. I think both authors make the case that Hurst’s methods from the mathematical viewpoint are much more complex than the simplified, synchronized trough method that is most often put forth as the Hurst method.

Hi William,

I have in PDF format all exemplaries of the Cycles review. They are at the disposal of those interested.

You could see the filiation between the works and results of the researchers of the FSC and what Hurst has written (vulgarised ???).

For me Hurst is not an icon. His “model” is just an “Initial Cyclic Model” good enough for a first cyclic reading of a financial instrument.

His cyclic “principles” were long ago defined by the various researchers of the FSC.

Note that in his book and course Hurst never made the slightest reference to these works and these people. Why ?

Note also that After 1975 Hurst has disappeared . Why? What was his life after this period ? Curious at least.

David,

Where are you? Its been 5-6 weeks since any update on the market which seems fairly lengthy. Just wondering what your take on what’s been going on over the last month and if we are expecting more downside? Hope you and your family are okay and doing well.

nice to see you here on board Ray !

by the way David it would be useful to have a new feature allowing to compare 2 instruments and even to calculate a percentage of correlation / commonality.

Which allows also to create “groups” having the same behaviour.

Alain

Sounds like an interesting feature Alain. I’m sure we could look into it:)

yes David

this will allow us to create “groups” of shares. 10 to 15 % of the components of each index has made a “6 year” low in october / november 2002 and october / november 2008.

2/3 to 75 % of the components of various indexes have made a “6 year” low in february/march 2003 and february/march 2009

Jim Tillman used the first as “pathfinders” – their behaviour was a warning for the behaviour of the second group

Yes, common cycles is important. When Dewey put common period cycles from different series together he found a great degree of common phase which he called “Cycle Synchrony”. I want to build up a catalog of such phases for all cycles periods as a starter. Then the phase of related cycles can be compared as Hurst and others have noted. Finally, I want to look at why cycles vary in phase and amplitude. If that one can be solved then predictions can be so much more accurate and trading that much more profitable. Using some of these techniques I was able to predict at FSC (Foundation for the Study of Cycles) conference (in late 1994 from memory) that we were at the trough of DJIA then and that the next cycles would be a slower one. Other speakers also identified it as the trough but no-one else had picked the slower cycle coming.

Hello Ray,

With all my respect . Changes in the amplitude and the cycle phase could there be any other answer besides the superposition principle?

Sorry Gary, I don’t understand what you are getting at, Ray

“I want to look at why cycles vary in phase and amplitude. If that one can be solved then predictions can be so much more accurate and trading that much more profitable”

Well, I think this can be solved with cycle superposition principal.

“commonality” is a vast subject and cycles troughs are not the only components.

I use also :

– Gann Angles

Long Term and Mid Term – are the financial instruments evolviing above or under their (1×1) Angle ( 1 Unit of Price x 1 Unit of Time)

– Fractal of Prices

in which “Fractal” are evolving the financial insruments (0/10, 10 / 100, 100 / 1000, 1000 / 10000, 100000)

– Center of Gravity

within their Fractal of Price are the Financial instruments evolving above or under their Center of Gravity – the middle of the Fractal

– Support Curve

are they under or above their support curve

I also find Gann angles or the natural rates of change helpful but only with in the framework of the cycle structure. Also I like using 1: 365/360 rather then 1: 1

Hi Alain ,

I am interested in those examplaries mentioned above. If you could flick it over via mail will be much appreciated regards Vito

Hi Vito !

which ones and how ?

Hi Alain,

Full articles you posted and + to edo199@hotmail.com. Regards

Vito