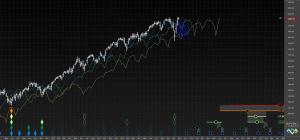

So here we are with new highs in the $SPX, $NDX, and the DOW. Even the $Nikkei has flashed new highs thanks to the BOJ’s aggressive QE announcement last week. Many world indices continue to lag though such as the $DAX and commodity heavy markets like the $TSX. It is easy to spot where the money is flowing. It is going straight into the USD and US related equities, a trend that seems unstoppable.

When we see this type of price action so late into larger cycle periods, one wonders if cycles actually matter. Central Banks world wide have had their way with monetary easing and there seems to be no end to it. Now that the US midterm election is out of the way, everyone is probably watching Mario Draghi and his comments tonight.

So with new highs, one has to conclude that we saw an 18 month cycle low here in October, with the actual cycle period running almost 16 months. We are only 4 weeks up into this new cycle. How right translated can this 9 year cycle extend? I have no preconceived ideas of what these markets will do from here. Each time you expect cycles to turn somewhat bearish, CBs step in to goose the markets.

Perhaps the only thing to keep in mind for now is that a 9 year Hurst cycle low (actual cycle period is expected to run approx. 7 years) is due late 2015 into 2016. How we get there is hard to see. I wonder how active CBs will be with QE from here through 2015.

cheers,

john

4 thoughts on “The Next 18 Month Hurst Cycle”

Looks like today will be a decision point. ES is trading above the Maginot line of 2016. Will Draghi’s comments be enough? I don’t like shorts above this level and would prefer to see a reversal before taking a bearish position.

N.B. Looks like Draghi is in a political mess at the ECB.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/11211973/Mario-Draghis-efforts-to-save-EMU-have-hit-the-Berlin-Wall.html

Hi John,

but as I remember your target is 2150 by November 27th 2014. Do you still see it as a target?

Thank you in advance.

Hi Ari,

If you read through the comments section of that thread (ie. $SPX 9 Year FLD Target of 2150?), the target is questionable based on which phasing is used. Let’s put it this way. I’m not betting on that target being achieved in this 9 year cycle. That’s not to say it won’t happen as targets can be exceeded in bullish markets, and this one is already in the books as one of the best bulls of the last century.

cheers,

john

Thank you.