It is often stated that the world stock market indices have similar cyclical structures. This is particularly true with respect to the US indices and the European indices (British,French,German). After watching David’s latest HTR video I decided to take a look from a spectral viewpoint. It turns out that they […]

Yearly Archives: 2014

For the past three weeks I have been discussing the move down into the 80-day cycle trough in the Hurst Trading Room podcasts. On Monday I discussed the reasons why I expected the trough to occur “early” – in other words earlier than the average 68 days, and how the FLD’s […]

A big moment for a Hurstonian is when price touches one of Hurst’s cyclic tools. (I am stealing William’s term Hurstonian, which sounds so much better than Hurstite, or Hurstie and is so much more fun than Hurst Analyst) As you are no doubt aware Hurst defined two cyclic tools, the FLD (Future […]

I have started writing this post several times over the past years, and have always given up after hours of work, with pages and pages of dense comparisons and similarities between Hurst Cycles and Elliott Wave. This time I am going to publish! The problem is that the subject is such […]

Utilizing a Sentient Trader organic analysis of the AUD/USD currency pair starting at the December 1996 high, it appears that the Aussie is headed down into a large cluster of cycle troughs, the largest of which is at least of the 18-month variety. Inside that cluster of troughs, the 26.4 […]

In September I discussed reasons why I expected the Euro to turn up in November or December of this year. That time is upon us, and I am watching the Euro carefully to see whether it is going to manage a turn up. I presented various ideas about the magnitude […]

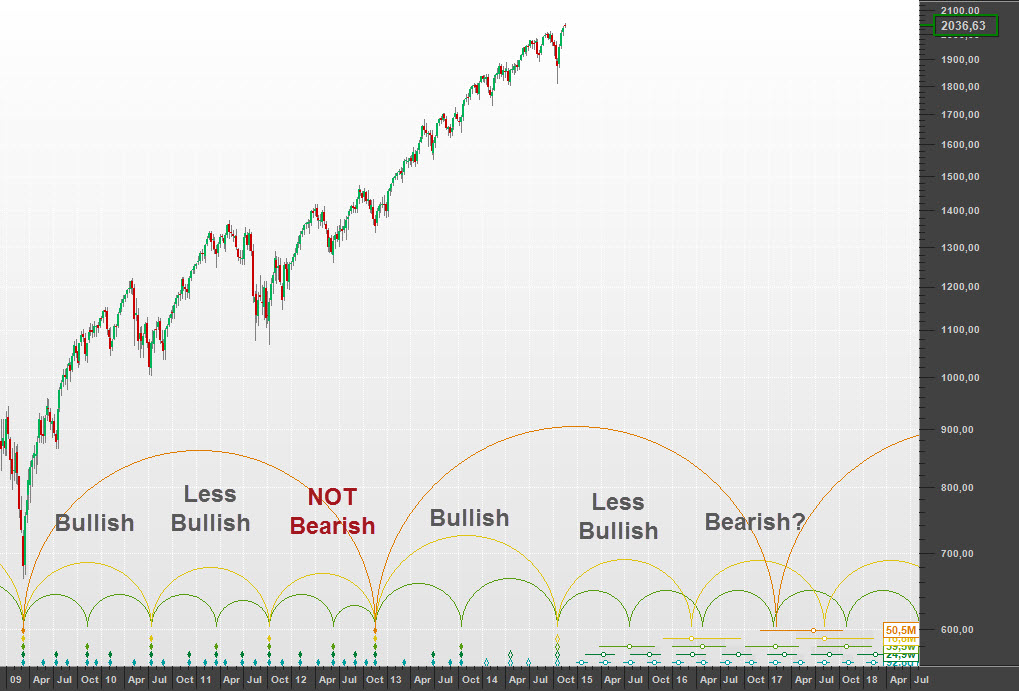

Performing a Hurst analysis is all about identifying the positions of cycle troughs in the price movement. But when the market is moving strongly, as it is at the moment, it can be very difficult to identify any troughs at all as can be seen in this chart of the […]

There is a moment that I love when analyzing markets using Hurst’s cyclic principles which is when all the pieces of the puzzle fit into place. It is an “Aha!” moment that removes analysis uncertainty, and suddenly we can see just a bit further into the misty future. Such a […]

So here we are with new highs in the $SPX, $NDX, and the DOW. Even the $Nikkei has flashed new highs thanks to the BOJ’s aggressive QE announcement last week. Many world indices continue to lag though such as the $DAX and commodity heavy markets like the $TSX. It is […]

EDIT: This post has sparked a good deal of heated reaction by email. I should explain that this post is not presented in the spirit of being a market call or an absolute forecast. My analysis process is to consider all the possibilities, and to stir up some debate. I do […]