I wrote about the $TSX in September as it broke the 40 week FLD. The TSX started its correction lower last fall before US markets, this on the back of a very weak energy sector. Despite oil’s recent bounce (/CL made a 45 week low late Jan.), the weakness in energy shares is likely to continue this year until the bottoming process is completed. The interesting thing is that concerns for Canadian energy debt/financing has pulled down the Canadian banks and we now see weakness developing there as well. The crash in oil last year could have a pervasive effect on the $TSX for much of 2015. Time will tell.

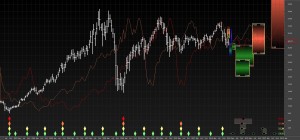

I’ve come to the conclusion that trying to analyze cycles in US markets or US stocks at the present time is not working very well. It is actually much easier to see the cycles working in assets outside of the US priced in US dollars. The first look is the ishares global ETF for Canada (EWC). I’ve taken a recent step and changed the nominal defaut cycles for Sentient and used a 13 month and 39 month cycle for the Hurst nominal 18 month and 4.5 year. William Randall’s bandpass filter work clearly shows these cycles are running shorter than Hurst’s original nominal model for stocks. I have also looked at a longer term price analysis and have found cycles to average more or less the same, perhaps 14 months and 42 months periods for these cycles. Sentient seems to have a much easier time identifying these cycles, particularly when working non-US assets for the moment. So in the case of EWC, price broke below the 4.5 and 9 year Hurst cycle FLDs and is trying to bottom. Follow through here would imply a continued rally in the USD and a weak $TSX.

I would add that this phasing contradicts the phasing I had last Sept. The $TSX is likely heading into the next 40 week low soon and the first of off the 18 month low last October.

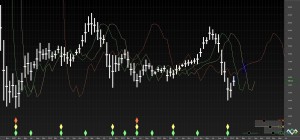

The next chart is XEG, the ishares $TSX Capped Energy Fund. The carnage has been terrific and there is real concern for some of the highly leveraged oil plays. If oil fails to head higher soon, say above $55, a retest is in the cards and it will have an impact elsewhere. Notice the bearish M-shaped price chart and lower high made last year. A full retest of the 2009 low looks likely sometime in the 2015. The break of the 4.5 year FLD targets 10.XX.

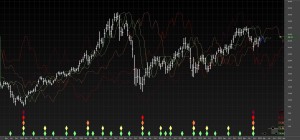

Weakness has spread to the financial sector where the Canadian Banks have corrected significantly for the first time since 2011/2012. When viewed in USD as traded on US markets, the correction looks more advanced than in $CDN charts. Nevertheless, Royal Bank for example has broken both its 4.5 and 9 year VTLs and is trading below its 40 week and 18 month FLDs, a trademark sign of a bear market. The Canadian Banks continued their declines to new lows despite the bounce in the $TSX. Weakness in Canadian Financials could continue until energy shares make a clear bottom.

What is unclear now is how much of an impact low oil prices will have on the overall Canadian economy and various TSX sectors. Non-bank financials such as insurance companies have not corrected very much. I would expect that over the course of 2015, we’ll see a negative sentiment that spreads to other sectors.

One market to watch though is the $DAX, and in particular the ishares ETF EWG. The German index is often looked to as a lead market to the $TSX. With a breakout to new highs in the $DAX thanks to ECB QE to infinity, does this suggest the $TSX will follow? Again I would defer to the USD priced EWG instrument for a signal. From a cycles point of view, EWG started its correction last year long before other assets and now the question is whether this is just a bounce to an important secondary peak, or a leading indicator for continued breakouts in other markets in general.

The interesting thing is that Sentient has marked the October low for EWG as a 9 year low (a very short 6 years at best in actual time). And again this is based on a revised nominal model as mentioned above. However this could have important consequences for markets if this phasing holds to be true. Unfortunately we won’t know for several weeks. As always, the markets are poised here to make an important move one way or another. And I learned my lesson last year and will not try to predict the outcome. But I will maintain that 2015 will prove to be volatile.

cheers,

john

3 thoughts on “$TSX Toronto Stock Exchange”

Hi John

I would like to begin my comment with a quote that appears on Robert Taylor”s website http://www.x9t.com

“This leaves unexplained Hurst’s all-important “semi-predictable” 23%. Designing 22 “comb filters” or narrow-bandpass filters whose overlapping bandpass intervals span the frequency range from 0 to 0.5 [the normalized anti-aliasing Nyquist frequency], and passing the DJIA through each comb in turn, and then subtracting the result from the DJIA and repeating with the next comb, Hurst decomposed 23% of the DJIA into the 10 or 11 oscillatory signals mentioned above. By identifying each of these 10 or 11 undulating, trembling sine-waves, and then “freezing” its amplitude A, period 2p/w, and phase f at its mean value, Hurst extrapolated each of these cycles into the future, with an aggregate stunningly effective result. (Our only reservation about this procedure is that when we tried it the results resembled simply assuming that the recent past would repeat itself almost exactly in the near future — the so-called Adam Theory of Sloman & Wilder [7].) Hurst sold the coefficients of a bank of “optimal” comb filters to one of his fans, Ray Frechette, for $350,000 and in their heyday, prior to Hurst’s disappearance [!], they developed a large following who made money consistently by acting upon their forecasts.

In his book [2], Hurst recounts a 30-day experiment done with the aid of friends, in which they proved that, even using crude hand-calculator and graphical methods, Hurst’s principles while paper trading sufficed to make a 9% profit every 9 days!

Alas, non-stationarity was to be the Achille’s heel of Hurst’s approach. In the late 70s the constant weighting coefficients which Hurst had optimized for earlier market conditions gradually became less and less effective. Frechette finally sent a pathetic letter to his subscribers saying that he was abandoning the methodology and pleading for someone to suggest a better approach! (If they had had PCs, and if the Hurst approach had been automated to be updated regularly, this debacle might not have occurred.)”

We know that cycles come and go(or more accurately are distorted/suppressed by the behavior of other cycles). And we are all too aware of the game being played by the world’s central banks. The question that you imply John is: can we use Hurst analysis in the face of all of this manipulation and distortion?…fundamental interaction on steroids!

My theory is it might still be possible but not without detection of information from the frequency domain. After all, Mr Frechette did not have a rocket scientist at his side to inform him of when things changed.

As has been discussed here, the 4.5 year cycle has been running short. The extraction of the dominant cycle coresponding to our nominal 4.5 year cycle seem to running at 43 mo taken from the trough and 41 mo at the peak.and since we have 4 oscillations of the cycle(we need at least 2), and since this analysis is accompanied by a Bartel’s score of about 87, there is a good probability that this is valid. (The Bartel’s test is a test of cyclic statistical significance; values greater tha 49 are considered valid(on a scale of 100)). This cycle also passes William’s “eyeball” test .

Inputting a cycle length of 42 mos (average of 41 and 43) and preventing ST excluding any cycle over 4.5 years (we don’t have enough data here to include it), I arrive at the following phasing. ST has taken my suggestion of 42 mos and likes 44.1 mo better but produces(objectively) a good analysis

A closer view would show the 4.5 year cycle phases at 44.1 mo and the 18 mo cycle at 17.1 mo.

Hi Stuart,

Thanks for the heads-up on the Xyber 9 Trends website. Very interesting reading. Any serious student of cycles should be well aware of the correlation between a synodic lunation (approximately 29.55 days) and the market indices. Two lunations are roughly the equivalent of the average 10 week price wave according to filter analysis.

His piece about Hurst was very good. I wish someone had offered me $350,000 after I was able to identify his comb filter parameters! Hurst did describe a solution to the non-stationarity issue in the market data, sideband modulation. He even provides a simple illustration of its effects. I think the reason most traders and analysts shy away from this approach is due to the relative complexity of the math. I find it to be very useful though.

The issue of “forecasting” has always intrigued me. Even though Hurst stated that the underlying trend could not be predicted with accuracy, there are a couple of analysts who claim otherwise. I believe that if one could accurately predict the underlying trend coupled with Hurst’s modulated nominal model, he or she would be the richest person in Babylon in very short order! I certainly plan to give it a try.

William